Opening Growth Prospective: Bagley Risk Management Approaches

Opening Growth Prospective: Bagley Risk Management Approaches

Blog Article

Just How Livestock Risk Defense (LRP) Insurance Coverage Can Secure Your Livestock Financial Investment

In the world of livestock financial investments, mitigating risks is extremely important to making certain financial security and growth. Animals Risk Security (LRP) insurance stands as a dependable guard against the uncertain nature of the market, using a strategic method to guarding your properties. By delving into the details of LRP insurance and its diverse benefits, animals manufacturers can fortify their investments with a layer of safety that goes beyond market changes. As we discover the world of LRP insurance, its function in protecting animals investments ends up being significantly apparent, promising a path in the direction of sustainable monetary strength in an unpredictable industry.

Understanding Livestock Threat Defense (LRP) Insurance Coverage

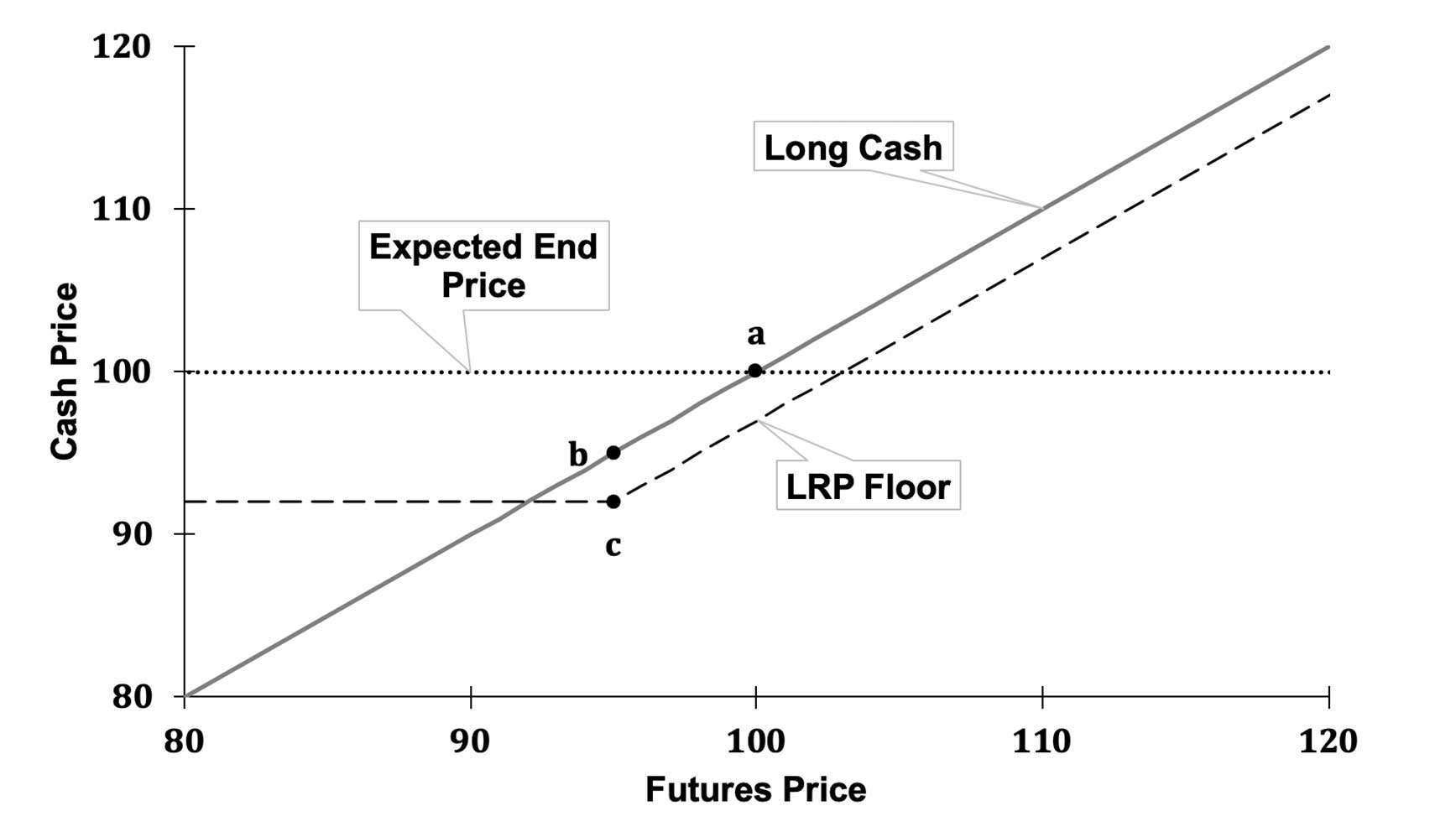

Understanding Livestock Threat Security (LRP) Insurance is crucial for animals manufacturers aiming to alleviate financial threats connected with price variations. LRP is a government subsidized insurance item developed to shield manufacturers against a decrease in market value. By supplying coverage for market rate declines, LRP aids manufacturers lock in a flooring cost for their animals, making sure a minimal level of revenue no matter of market fluctuations.

One secret facet of LRP is its flexibility, permitting manufacturers to customize insurance coverage levels and policy sizes to match their particular demands. Producers can select the variety of head, weight range, protection cost, and insurance coverage duration that line up with their manufacturing goals and run the risk of tolerance. Comprehending these customizable alternatives is vital for producers to properly handle their price danger direct exposure.

In Addition, LRP is available for various livestock kinds, consisting of livestock, swine, and lamb, making it a versatile risk management tool for livestock producers across different markets. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make informed decisions to protect their investments and make certain monetary security despite market unpredictabilities

Advantages of LRP Insurance Policy for Animals Producers

Livestock producers leveraging Livestock Threat Security (LRP) Insurance coverage gain a critical benefit in securing their financial investments from rate volatility and protecting a secure economic ground in the middle of market unpredictabilities. One crucial benefit of LRP Insurance is price protection. By establishing a flooring on the cost of their livestock, manufacturers can mitigate the threat of substantial economic losses in the occasion of market recessions. This allows them to intend their spending plans extra successfully and make notified decisions about their operations without the continuous worry of price variations.

Additionally, LRP Insurance offers manufacturers with comfort. Understanding that their financial investments are guarded against unanticipated market modifications permits manufacturers to focus on various other elements of their organization, such as enhancing pet wellness and welfare or enhancing manufacturing procedures. This satisfaction can result in boosted performance and profitability over time, as producers can run with even more self-confidence and stability. Generally, the advantages of LRP Insurance coverage for animals manufacturers are significant, offering a valuable tool for managing risk and guaranteeing monetary safety and security in an uncertain market environment.

Just How LRP Insurance Policy Mitigates Market Dangers

Mitigating market risks, Animals Threat Security (LRP) Insurance gives livestock manufacturers with a dependable shield against rate volatility and financial unpredictabilities. By using protection against unexpected cost drops, LRP Insurance policy assists manufacturers secure their financial investments and keep monetary security when faced with market variations. This kind of insurance coverage allows animals producers to lock in a rate for their animals at the start of the policy duration, ensuring a minimal price level no matter blog here market changes.

Steps to Protect Your Livestock Investment With LRP

In the realm of agricultural risk management, executing Animals Threat Defense (LRP) Insurance policy entails a critical procedure to secure financial investments versus market changes and uncertainties. To secure your livestock financial investment properly with LRP, the initial step is to evaluate the particular risks your procedure encounters, such as cost volatility or unexpected weather occasions. Recognizing these dangers enables you to determine the coverage degree needed to secure your investment sufficiently. Next, it is crucial to study and choose a reputable insurance click for source policy company that provides LRP plans customized to your livestock and organization requirements. Once you have selected a company, thoroughly assess the policy terms, problems, and insurance coverage limitations to guarantee they line up with your risk administration goals. Furthermore, on a regular basis keeping an eye on market trends and changing your coverage as needed can aid optimize your defense versus prospective losses. By adhering to these steps faithfully, you can enhance the security of your animals financial investment and navigate market unpredictabilities with self-confidence.

Long-Term Financial Safety And Security With LRP Insurance

Guaranteeing enduring financial stability via the application of Animals Threat Defense (LRP) Insurance policy is a sensible long-lasting method for agricultural producers. By incorporating LRP Insurance policy right into their threat administration plans, farmers can safeguard their animals financial investments versus unanticipated market changes and adverse occasions that can endanger their financial health in time.

One secret benefit of LRP Insurance for lasting monetary security is the assurance it uses. With a trustworthy insurance coverage policy in position, farmers can alleviate the monetary risks linked with volatile market problems and unforeseen losses due to variables such as illness outbreaks or all-natural disasters - Bagley Risk Management. This stability permits producers to concentrate on the daily operations of their livestock organization without continuous stress over prospective monetary setbacks

Furthermore, LRP Insurance gives a structured strategy to managing threat over the long-term. By establishing details insurance coverage levels and picking appropriate recommendation durations, farmers can tailor their insurance coverage intends to line up with their economic goals and run the risk of resistance, guaranteeing a protected and lasting future for their livestock operations. In verdict, purchasing LRP Insurance is a positive approach for agricultural producers to accomplish long-term financial safety and security and secure their livelihoods.

Verdict

In conclusion, Livestock Risk Security (LRP) Insurance coverage is a useful tool for livestock manufacturers to minimize market threats and safeguard their financial investments. It is a sensible option for guarding livestock financial investments.

Report this page