The San Diego Home Insurance Ideas

The San Diego Home Insurance Ideas

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Program

Significance of Affordable Home Insurance Coverage

Protecting budget friendly home insurance coverage is vital for securing one's residential property and monetary well-being. Home insurance provides protection versus different risks such as fire, burglary, all-natural catastrophes, and personal liability. By having a comprehensive insurance policy plan in place, home owners can relax ensured that their most significant financial investment is protected in case of unanticipated scenarios.

Cost effective home insurance coverage not only supplies financial security but likewise provides assurance (San Diego Home Insurance). When faced with climbing home worths and building costs, having a cost-effective insurance plan makes certain that house owners can easily restore or fix their homes without dealing with substantial monetary concerns

Furthermore, affordable home insurance policy can also cover personal valuables within the home, using repayment for products harmed or stolen. This coverage expands past the physical structure of the residence, shielding the materials that make a house a home.

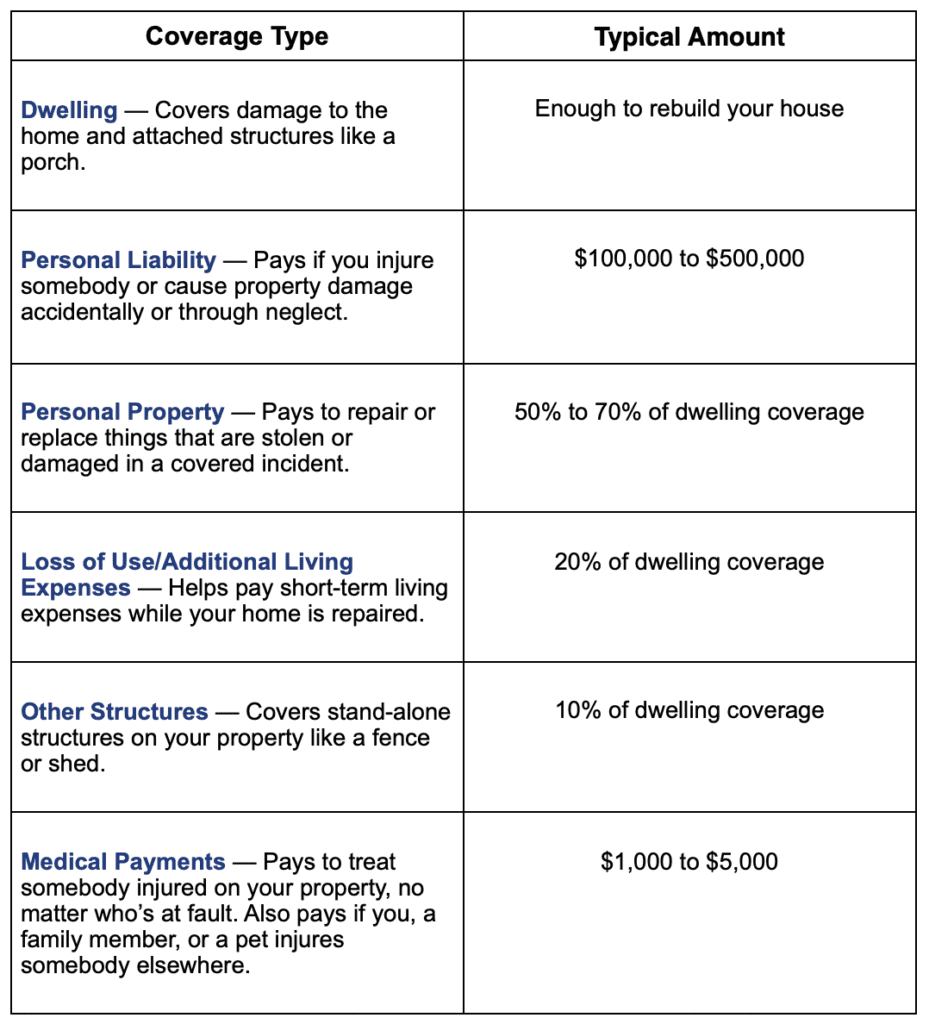

Protection Options and Purviews

When it pertains to insurance coverage limitations, it's important to recognize the maximum amount your policy will certainly pay for each and every kind of protection. These limitations can differ depending on the plan and insurer, so it's necessary to assess them thoroughly to ensure you have appropriate security for your home and assets. By comprehending the insurance coverage alternatives and restrictions of your home insurance plan, you can make enlightened decisions to secure your home and liked ones successfully.

Aspects Impacting Insurance Coverage Expenses

Numerous variables significantly influence the prices of home insurance plans. The area of your home plays an important duty in establishing the insurance policy costs. Houses in areas prone to natural catastrophes or with high criminal offense rates typically have greater insurance coverage costs because of enhanced risks. The age and problem of your home are likewise elements that insurance providers consider. Older homes or homes in bad condition might be a lot more expensive to guarantee as they are a lot more at risk to damages.

Moreover, the browse around these guys type of protection you pick directly impacts the cost of your insurance coverage policy. Choosing for extra insurance coverage alternatives such as flooding insurance policy or earthquake coverage will increase your premium.

Furthermore, your credit history score, declares background, and the insurance policy firm you pick can all affect the rate of your home insurance coverage policy. By considering these elements, you can make informed decisions to help manage your insurance policy sets you back properly.

Contrasting Quotes and Service Providers

In enhancement to contrasting quotes, it is essential to examine the credibility and monetary stability of the insurance coverage providers. Search for client evaluations, rankings from independent firms, and any kind of background of issues or governing activities. A reputable insurance coverage provider should visit this site have a good track record of promptly refining cases and giving outstanding client service.

Furthermore, take into consideration the certain coverage features supplied by each copyright. Some insurance firms might provide fringe benefits such as identity burglary security, equipment failure protection, or coverage for high-value products. By very carefully contrasting suppliers and quotes, you can make a notified choice and choose the home insurance plan that best meets your demands.

Tips for Saving Money On Home Insurance Policy

After completely contrasting quotes and suppliers to locate the most suitable protection for your demands and budget plan, it is sensible to explore efficient strategies for reducing home insurance coverage. Among one of the most significant methods to minimize home insurance policy is by bundling your policies. Several insurance provider use discounts if you buy numerous plans from them, such as combining your home and automobile insurance. Enhancing your home's safety and security actions can also result in financial savings. Mounting security systems, smoke detectors, deadbolts, or a lawn sprinkler system can decrease the threat of damages or theft, potentially reducing your insurance policy costs. In addition, keeping a good credit history can favorably influence your home insurance rates. Insurance providers frequently take into consideration credit rating when identifying costs, so paying costs promptly and managing your credit history properly can lead to lower insurance costs. Routinely evaluating and updating your plan to show any kind of modifications in your home or scenarios can guarantee you are not paying for protection you no longer demand, assisting you save money on your home insurance policy costs.

Verdict

Finally, guarding your home and enjoyed ones with budget-friendly home insurance is important. Comprehending insurance coverage options, variables, and limits impacting insurance prices can assist you make notified choices. By comparing carriers and quotes, you can find the finest plan that fits your demands and budget. Executing tips for minimizing home insurance policy can likewise assist you safeguard the essential security for your home without damaging the financial institution.

By unraveling the intricacies of home insurance policy strategies and checking out functional strategies for securing budget friendly insurance coverage, you can make certain reference that your home and liked ones are well-protected.

Home insurance coverage policies typically provide a number of coverage alternatives to secure your home and items - San Diego Home Insurance. By comprehending the coverage alternatives and limitations of your home insurance policy, you can make enlightened decisions to safeguard your home and liked ones efficiently

Routinely reviewing and upgrading your plan to show any changes in your home or conditions can guarantee you are not paying for coverage you no longer need, aiding you save cash on your home insurance coverage costs.

In final thought, safeguarding your home and liked ones with cost effective home insurance policy is important.

Report this page